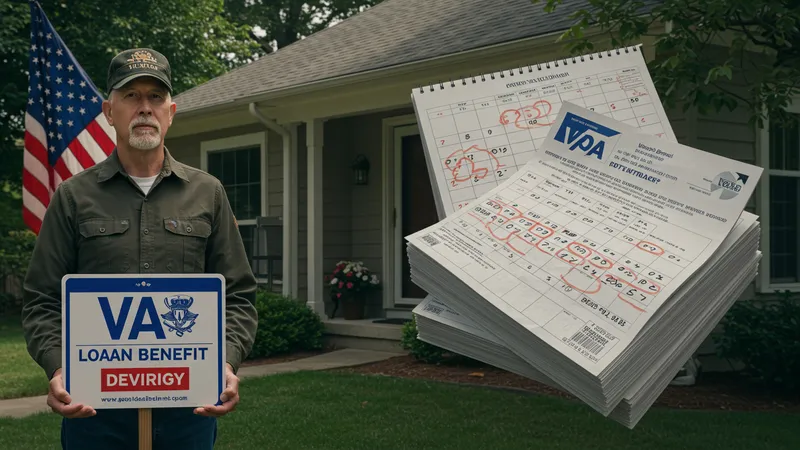

What Are VA Loans Benefits That Most Veterans Overlook

Cost-Cutting Strategies that Add Up

It’s easy to overlook just how much money can be saved through VA loan benefits. Beyond the obvious like zero-down payments, there are subtle strategies for veterans to optimize their expenses further. One such strategy involves property tax exemptions applicable in many states—a lesser-known benefit for veterans owning homes through VA loans.

Veterans might qualify for partial or even full exemption from property taxes, depending on the state and individual circumstances. The savings here can easily add up, creating additional room in the budget for other compelling financial goals. Imagine the financial relief from canceling sizable tax deductions annually—these are game-changing numbers.

Beyond property taxes, home improvements funded through the VA’s Energy Efficient Mortgage (EEM) program can enhance energy savings, reducing utility costs over time. Veterans can finance these upgrades through the loan, translating into lower energy bills and more sustainable living.

As such savings accumulate, the overall financial landscape for any veteran becomes both wider and more secure. But the story is far from over; there’s even more to uncover about maximizing VA loan benefits, leading to some awe-inspiring advantages.