What Are VA Loans Benefits That Most Veterans Overlook

Exploring Loan Flexibility

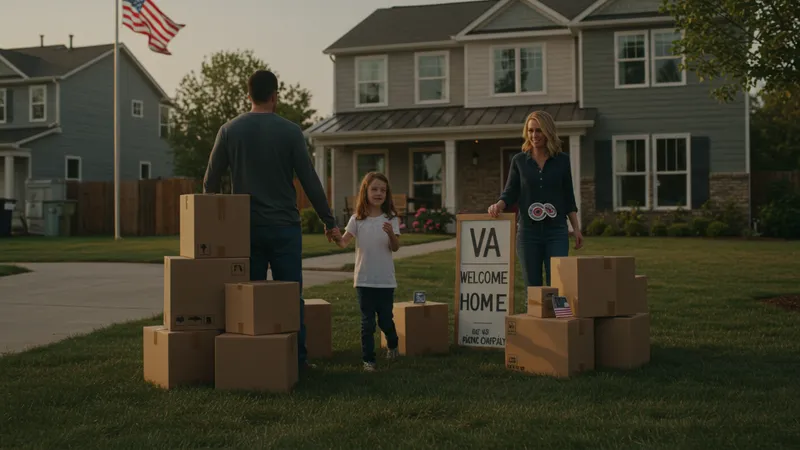

VA loans are renowned for their flexibility, offering terms that adapt to a veteran’s changing needs throughout their lifecycle. Whether it’s a growing family needing a larger home or a sudden relocation due to career change, VA loans offer adaptability that conventional mortgages rarely match.

Adjustable rate mortgage (ARM) options allow veterans to take advantage of lower initial interest rates. This can be a savvy move for those planning to refinance or sell before the rates adjust, providing savings when it’s needed most. Unlike rigid traditional loans, VA options give veterans room to maneuver and manage expenses as circumstances evolve.

Moreover, the VA Streamline Refinance, easily accessible to VA loan holders, simplifies the refinancing process. This benefit requires less documentation, omits extensive credit checks, and, crucially, doesn’t mandate home appraisal, making it a stress-free experience that most civilians envy.

These flexible terms mean veterans can make stronger financial game plans, reinforcing their security over time. So, what does this mean for you? The possibilities with VA loans don’t end here. The next page reveals a hidden factor that could further shift your perspective.