What Are VA Loans Benefits That Most Veterans Overlook

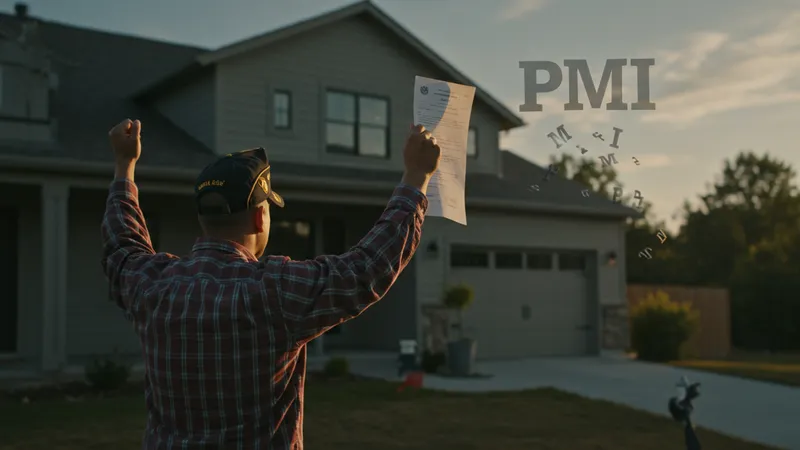

Say Goodbye to Private Mortgage Insurance

A common pitfall of civilian home loans is the dreaded Private Mortgage Insurance (PMI). Designed to protect lenders, PMI is often an unavoidable expense for homebuyers unable to make large down payments. For veterans, however, that’s one cost they don’t have to worry about with VA loans.

The VA loan’s exemption from PMI is a financial relief that provides an edge to veterans entering the housing market. This removal of PMI fees can significantly lower monthly costs and increase the affordability of homeownership, allowing veterans to build equity without extra stress.

Consider the typical savings: the average PMI can hike monthly payments by hundreds of dollars—that’s thousands saved every year purely due to the VA loan structure! Instead of pouring hard-earned money into PMI, veterans can invest in other areas that impact their lives more directly.

And for those thinking about how PMI affects long-term wealth building, it’s about unlocking potential. Removing PMI grants more ability to pay down principal faster, gaining equity sooner, and forging a clearer path to financial freedom. But that’s just one piece of the puzzle…