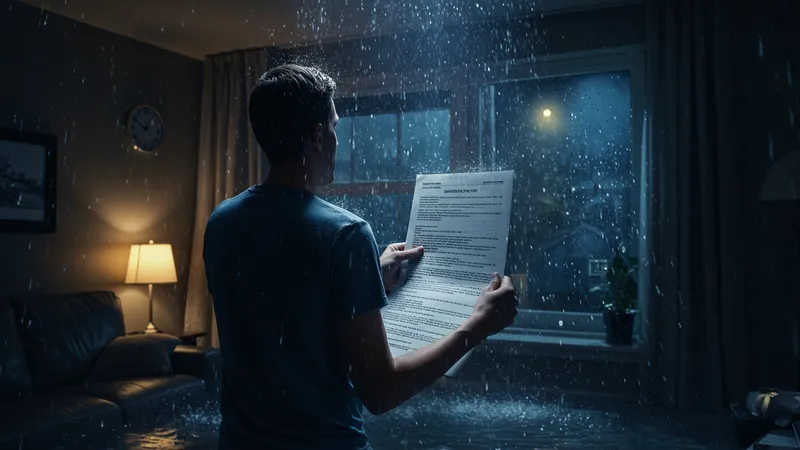

Water Damage Restoration Services – 24/7 Emergency Response. Explore !!

Insurance Nightmares: Untold Truths About Coverage

Not all is as it seems with insurance policies covering water damage. The industry is filled with terms like “sudden and accidental” that can leave homeowners scratching their heads. If the damage is considered “gradual,” you may find your claims denied. Some companies even have clauses that exclude certain types of water damage altogether. But why is this the case? It turns out, industry jargon is intentionally complex to reduce the liabilities of the insurers.

Even more alarming, many homeowners never realize the specifics of their coverage until disaster looms. A staggering 62% of policyholders are unaware of the exclusions in their plans, according to recent surveys. But what’s even more concerning is how easily some companies deny coverage on technicalities, sidestepping responsibility when you need them the most.

There are instances where policyholders have been denied claims because of simple oversights, like forgetting routine maintenance that supposedly would have prevented the damage. The fine print can bind homeowners to conditions many wouldn’t even think to adhere to, like annual roof inspections. Knowing these traps beforehand can save thousands, but it begs the question, why aren’t policyholders better informed?

Yet, a growing trend is reshaping the landscape. Some pioneering insurers are now simplifying policies and offering real transparency, creating policies with true protection minus the confusing legacies of outdated models. These moves are changing the game, making it more crucial than ever to review your coverage. But dig deeper, and you’ll see there’s even more startling information to uncover…