Top-Rated Mold Removal Services Near You – Free Estimates Available

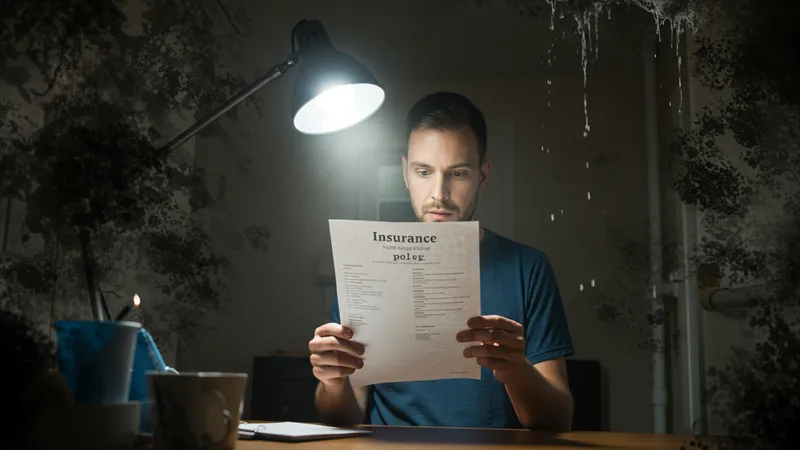

The Game-Changer: Insurance and Mold Removal

Here’s something many don’t realize: your homeowner’s insurance might actually cover mold damage! It’s a game-changer for those shying away from removal services due to financial constraints. However, understanding the policy terms is crucial, as coverage often hinges on the type of mold and the cause of its growth.

Insurance companies typically cover mold damage when it results from a covered peril, like water damage from bursting pipes. However, neglect can lead to denial. Knowing how to navigate insurance claims can mitigate costs significantly—yet many homeowners remain unaware of these options.

Having the right documentation is key. Mold inspectors can provide thorough reports and photos, making it easier to substantiate an insurance claim. Savvy homeowners ensure these documents are meticulously prepared, streamlining the claim process.

If successful, insurance can alleviate financial burdens, allowing for comprehensive mold remediation services. But the process is full of hurdles. What you’ll read next might just open your eyes to industry secrets…