Compare Car Insurance Quotes In Your Zip Code

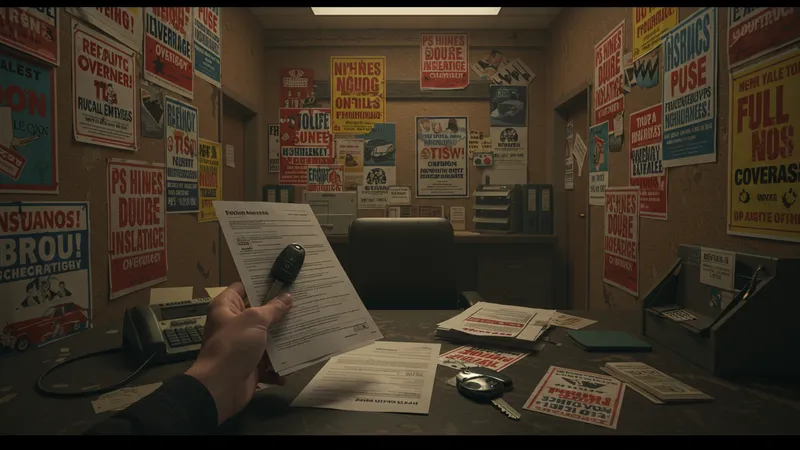

The Myth of Full Coverage

Many drivers chase “full coverage” believing it’s their safety net. Is it truly the best fit, or just a marketing myth? Skewed perceptions and aggressive advertising often lead you down this compelling — yet costly — path. Let’s break down an illusion that’s been long-held.

Full coverage sounds comprehensive, but it often leads you to buy unnecessary add-ons, fattening your premiums without considerable benefit in return. Especially if your vehicle is older, opting for full coverage could mean paying more than the worth your car can justify.

Wondering if you’re getting your money’s worth? Delving into your policy and removing redundant options might reveal uncovered savings where you hadn’t looked before. Yet, there’s one more layer to unravel.

What if full coverage doesn’t cover everything after all? Therein lies a Pandora’s box of unexplored insurance truth — what might appear as a safety net could potentially be filled with gaps just waiting to trip you up. This revelation might radically alter your insurance approach.