Homeowners Insurance Explained: Coverage, Costs & Providers In 2025

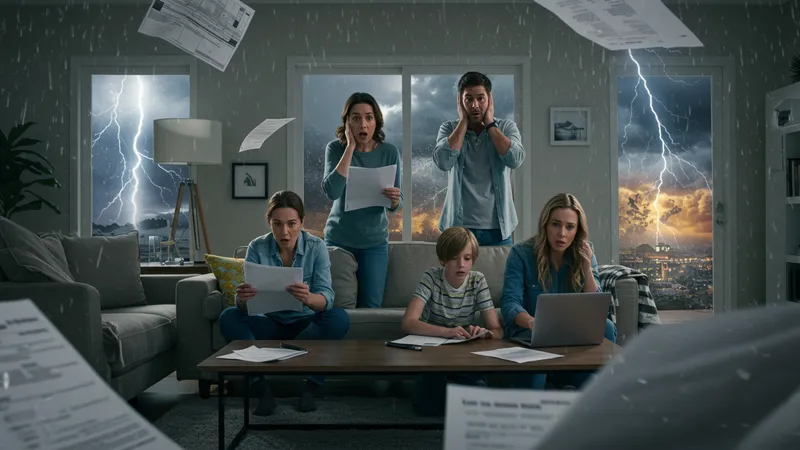

In 2025, homeowners insurance is more confusing than ever, leaving many at a loss about what it truly covers. Amidst the chaos, one hidden truth remains: most homeowners are unknowingly underinsured, risking significant financial loss.

With climate change intensifying natural disasters, understanding homeowners insurance is critical. New laws and market shifts make it urgent for everyone to reassess their coverage immediately. Get ready to uncover the surprising world of insurance.

- Renowned for exclusive analytics, Policygenius streamlines comparisons, starting at $25/month.

- Acclaimed for innovative AI assessments, Lemonade Insurance offers coverage from $5/month.

Did you know that 30% of homes are covered under outdated policies that drastically undervalue the cost of damages? Even more astonishing is the revelation that many insurers quietly exclude certain extreme weather events. But that’s not even the wildest part…

An overlooked fact is that certain thefts and household accidents often aren’t covered. Policies vary greatly, yet a staggering number of agents don’t disclose key exclusions unless asked. But that’s not the full story…

What happens next shocked even the experts: you’re about to discover the unexpected ways to maximize your coverage and minimize costs, something even seasoned homeowners often miss. Let’s dive deeper into the tangled web of homeowners insurance.